Shining Years

Deferred Annuity Plan

Growing Wealth for a Better Retirement

Growing Wealth for a Better Retirement

To craft a brilliant and worry-free retirement, you need the right tool to plan ahead and build your fruitful retirement reserves.

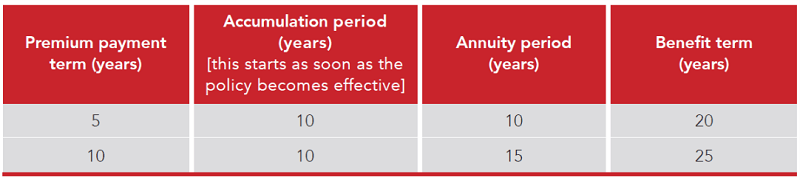

Tahoe Life’s Shining Years Deferred Annuity Plan1 (the “Plan”) is a Qualifying Deferred Annuity Policy (“QDAP”) certified by the Insurance Authority#, not only allowing you to apply for tax deduction##, but also giving you steady monthly annuity payment2 during the annuity period and protections against unfortunate events.

The Plan offers monthly annuity payment during the annuity period selected by you according to your financial needs. The monthly annuity payments are comprised of both guaranteed and non-guaranteed4 portions. Therefore, the monthly annuity payments are not guaranteed. You may choose to receive the monthly annuity payment in cash monthly or to leave them in the policy to earn interest5.

The prepayment option6 is available for the 5-year premium payment term only, allowing you to enjoy a non-guaranteed interest7 and pay less.

In the unfortunate event of the death of the insured, the designated beneficiary will receive the death benefit in lump-sum.

If the insured is unfortunately diagnosed with a terminal illness, the Plan will advance the death benefit in a lump-sum payment as the terminal illness benefit, in order to provide emergency cash to the policyowner for more appropriate arrangements.

The Plan provides an accidental death benefit for the insured. Its coverage is equivalent to 50% of the total premiums due and paid of the policy, up to USD125,000 or HKD1,000,000 (per insured on all in force Shining Years Deferred Annuity Plan), providing added protection to you and your loved ones.

In case you are unemployed for at least 30 consecutive days or suffer from one of the critical illnesses including cancer, heart attack, kidney failure, stroke or undergoing a coronary artery bypass surgery, you can apply for extending the grace period of the Plan from 31 days to a maximum of 365 days, during which you will still enjoy the coverage of the Plan. You may pay the premium due without interest by the end of the extended grace period and the policy will still remain effective.

Simple and hassle free application with no health declaration and medical underwriting required.

The Plan is a QDAP that has been certified by the Insurance Authority to be compliant with its Guideline on Qualifying Deferred Annuity Policy. By taking up the Plan, you may be eligible for tax deductions under salaries tax and personal assessment up to HKD60,00012 per taxpayer each year during premium payment term.

# The Insurance Authority certification of QDAP is not a recommendation or endorsement of the Plan nor does it guarantee the commercial merits of the Plan or its performance. It does not mean the Plan is suitable for all policyowners nor is it an endorsement of its suitability for any particular policyowner or class of policyowner. The Plan has been certified by the Insurance Authority but such certification does not imply official recommendation. The Insurance Authority does not take any responsibility for the contents of the product brochure of the Plan, makes no representation as to its accuracy or completeness, expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of the product brochure of the Plan.

## Please note that the QDAP status of the Plan does not necessarily mean you are eligible for tax deduction available for QDAP premiums paid. The Plan’s QDAP status is based on the features of the product as well as certification by the Insurance Authority and not the facts of your own situation. You must also meet all the eligibility requirements set out under the Inland Revenue Ordinance and any guidance issued by the Inland Revenue Department of Hong Kong Special Administrative Region (“IRD HKSAR”) before you can claim these tax deductions. The actual tax benefits of this policy would depend on your personal tax position and there might not be tax deductions benefits if you are not subject to salaries tax or personal assessment in the relevant year of assessment.

Any general tax information provided is for your reference only, and you should not make any tax-related decisions based on such information alone. You should always consult with a professional tax advisor if you have any doubts. Please note that the tax law, regulations or interpretations are subject to change and may affect related tax benefits including the eligibility criteria for tax deduction. We do not take any responsibility to inform you about any changes in the laws and regulations or interpretations, and how they may affect you. Further information on tax concessions applicable to QDAP may be found at www.ia.org.hk/en/.