In 2015, the 39th President of the US, Jimmy Carter, was given a terminal diagnosis when melanoma metastasized to his liver and brain. His doctor estimated that he had just a few weeks to live. Yet, he totally recovered from cancer after 7 months thanks to the latest immunotherapy drugs in combination with radiation1.

This cancer-fighting drug is stunning and brings new hope to patients with similar cases. Nonetheless, the medication alone costs nearly HKD 100,000 a month1, with addition of surgical fee, room and board, rehabilitation after treatment including physiotherapy, nutritional advice and psychological counselling, the annual medical cost can well be over one million dollars. Patients combat with cancer and, at the same time, struggle with the heavy financial burden owing to all these extra medical costs.

When we are healthy, we always believe that we are able to afford the medical cost even when are unfortunate to suffer from critical illnesses. Indeed, when we are diagnosed with a critical illness, we may need to take rest for an extended period of time in addition to the period we are under treatment. Sufferers are likely to suspend their work and retain their position only, or even worse, lose their job. Family members thus lose the financial support and their everyday lives will definitely be affected.

Based on a recent research conducted by the Chinese University of Hong Kong, the onset of colorectal cancer, the most common cancer in Hong Kong2, tends to occur at a younger age3. These days have seen a continual increase in cases of incidence in ages below 55. Gastroenterology & hepatology specialists further pointed out that colorectal cancer sufferers between 20 and 30 years old were 20% more than 20 years ago4. The risk of having critical illnesses increases with factors including fast pace of life, stressful work, as well as lack of exercises and high-fiber food.

If critical illness claim is one-off only, its policy will expire once the life insured is diagnosed with a critical illness and the claim is successfully made. Although the patient has gained financial support, he or she may need to face with various challenges on the road of recovery, including metastasis and recurrence, which may prolong the recovery time and increase the treatment cost unexpectedly. This pre-existing condition, however, makes cancer patients difficult to enhance their critical illness coverage. Even they are insured, some coverage areas may be excluded accordingly, or the premium may be loaded. Consequently, it’s essential for us to plan ahead for our health protection before our health is getting worse.

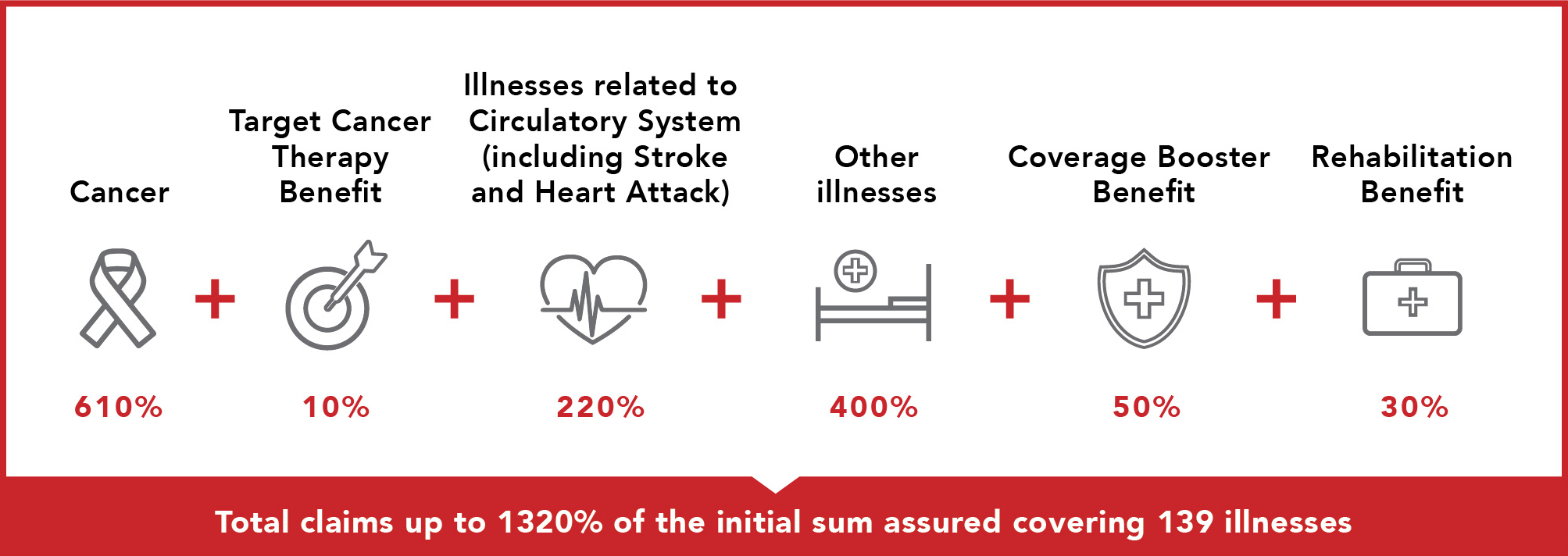

Tahoe Life’s “1320 MultiCare Critical Illness Plan” offers you comprehensive protection for critical illnesses. The Plan provides multiple claim protection, including cancer claim up to four times. The total coverage amount is up to 1320% of the initial sum assured, securing your future with the greatest support when you are in bad health.

As the breadwinner in the family, Mr Chan understands that it’s important to prepare for any unexpected diseases in order to protect himself and his family. He thus took out the “1320 MultiCare Critical Illness Plan” when he was 30 years old. The sum assured is USD 300,000 and the annual premium is just USD 10,041. The premium payment term is 20 years.

When he was 38, he was diagnosed with lung carcinoma-in-situ. He was further diagnosed with lung cancer and colorectal cancer in the following 10 years. On his doctor’s recommendation, he was treated with a series of genetic profiling tests and targeted cancer therapies. He successfully claimed an amount of USD 895,000, about 300% of the initial sum assured. As the Plan offers a total protection amount up to 1320% of the initial sum assured, Mr Chan could still be entitled to the remaining protection amount before his age of 65, making him and his family hassle-free.

*The above product features illustrated are for reference only. Please refer to the product brochure and policy document for details.

Sources:

1. 月費近10萬抗癌新藥 卡特7個月癌消失(Chinese only) (HKET / 7 March 2016)

2. 10 most common cancers in Hong Kong in 2015 (Hong Kong Cancer Registry, Hospital Authority / 24 August 2018)

3. CUHK Study Sees Increasing Global Incidence of Colorectal Cancer Among Younger People (Communications & Public Relations Office, The Chinese University of Hong Kong/ 12 June 2018)

4.【了解腸癌】大腸癌年輕化 忽視警號 確診已晚 (Chinese only) (Health Feature, Ming Pao / 4 December 2017)