Supreme Saver

Protection Plan

Tahoe Life's flagship savings product with Guaranteed Return Rate Up to 4% p.a. and 5-year Benefit Term

Are there some financial goals on your bucket list which have been set aside for a long time? A plan with guaranteed return could help you achieve your goals. Tahoe Life’s Supreme Saver Protection Plan (the “Plan”) addresses your savings needs as well as protection needs. With 2 years premium paid, you can enjoy 5 years of protection. It also brings you guaranteed return which helps you accumulate wealth steadily and effectively within a designated timeframe.

Recent Award

BENCHMARK Wealth Management Awards 2019:Outstanding Achiever award in the Retirement Product category(Splendid Harvest 2 Income Plan)

Outstanding Brand Awards 2019 organised by the Economic Digest: Savings Product (Splendid Harvest Income Plan)

“Excellent Brand of Savings Insurance Products and Services” Award of Hong Kong Leaders’ Choice 2019 (Splendid Harvest Income Plan)

Features

Guaranteed Return Rate Up to 4% p.a.

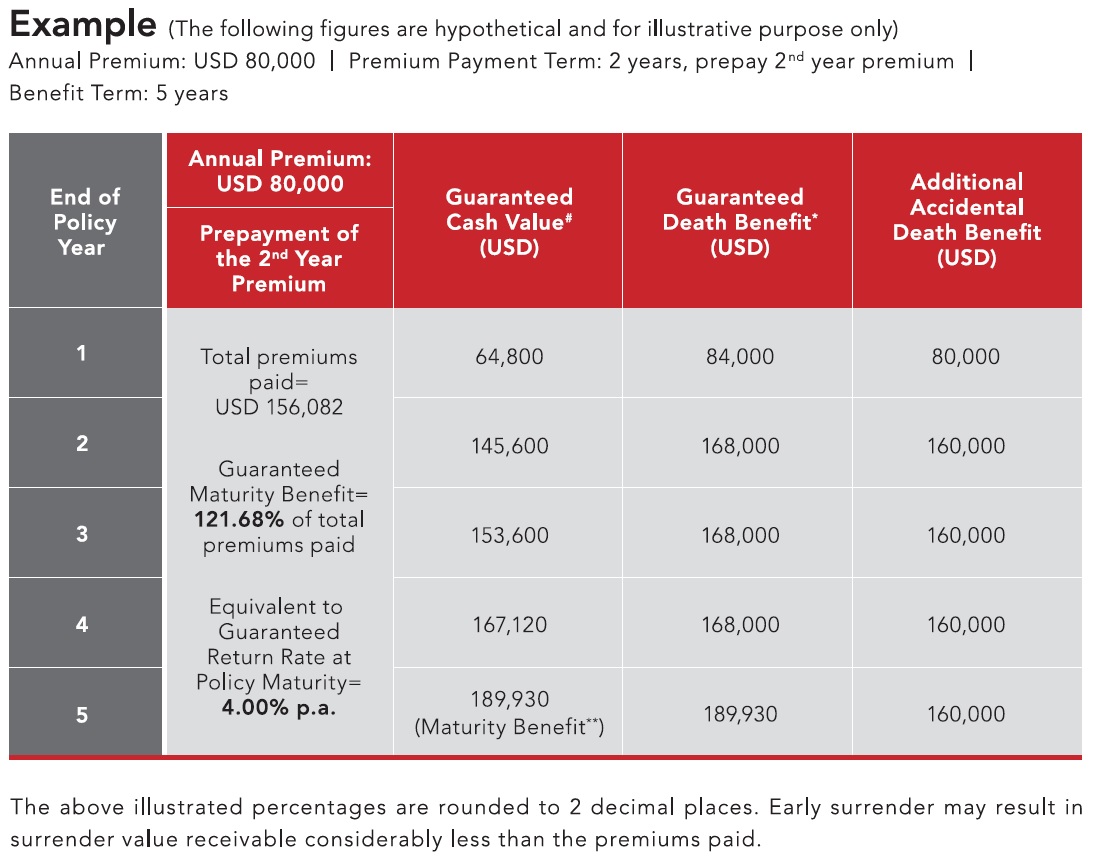

The policy currency is in USD. When the policy matures (i.e. on the 5th policy anniversary date), the Plan will provide you with a guaranteed Maturity Benefit1 of 118.71%2 of the total premium paid, which is equivalent to a guaranteed return rate of 3.88% p.a.2.

If you choose to prepay your 2nd year premium at the time of policy application, you can enjoy guaranteed Maturity Benefit1 of 121.68%2 of the total premium paid, which is equivalent to a guaranteed return rate of 4.00% p.a.2.It helps you accumulate wealth easier and achieve your savings target within an expected timeframe.

Accumulate Prepaid Premium at Guaranteed Interest Rate of 5.15% p.a

You can choose to prepay your 2nd year premium at the time of policy application to help you save on premium. The prepaid premium will be accumulated at a guaranteed interest rate of 5.15% p.a.3. The guaranteed interest will only be used for the settlement of the 2nd year premium, you are only required to pay the net premium after deducting the guaranteed interest.

2-year Short Premium Payment Term with 5-year Benefit Term

The premium payment term of the Plan is just 2 years, while the benefit term is 5 years. The premium is guaranteed to remain unchanged once it is determined and will not be increased with your age, facilitating better financial planning for your future.

Life Protection

Accidental Death Benefit

No Medical Underwriting

Grow your wealth in 5 years