Premier Life

Insurance Plan

- High-end life protection

- Great arrangements that meet your needs

- Efficient transfer of legacy

Amassing enormous wealth and remarkable achievements, you also value the quality of life of your next generations, hoping to create a more prosperous future for them. Tahoe Life understands that it is important for you to transfer your legacy. Tahoe Life’s Premier Life Insurance Plan (the “Plan”) is meticulously designed from the perspective of high-net-worth individuals to not only allow you to allocate your wealth entirely as you wish, but also pass your assets to your future generations, providing security of life protection for your beloved family members.

Features

High-end life protection up to 118% of the sum assured

In the unfortunate event of the death of the insured before the 20th policy anniversary date or age 75 of the insured, whichever is later, the Plan provides a guaranteed death benefit that is equivalent to 118% of the sum assured, accumulated annual dividends1 and interest (if any) and terminal dividend1 (if any), securing a prosperous future for your beloved family members.

|

If the insured passes away |

Guaranteed death benefit (percentage of the sum assured) |

|

Before the 20th policy anniversary date or age 75, whichever is later |

118% |

|

After the period specified above |

100% |

For example, if the insured is aged 35 when the policy is purchased, the insured enjoys the death benefit equals to 118% of the sum assured before the age of 75; or if the insured is aged 60 when the policy is purchased, the insured enjoys the death benefit of 118% of the sum assured before the age of 80.

Policy dividends to accelerate growth potential

The Plan will pay out annual dividends on its policy anniversary date to help grow your wealth. You may choose to leave the annual dividends in the policy to earn interest, or to receive them in cash, or apply them towards future premium payments to help realise your life goals.

If the Plan has been effective for ten years, it will also bring you additional returns by providing a terminal dividend upon the surrender of the policy, the maturity of the policy, the death of the insured or the payout of the terminal illness benefit. Both the annual dividends and terminal dividend are not guaranteed.

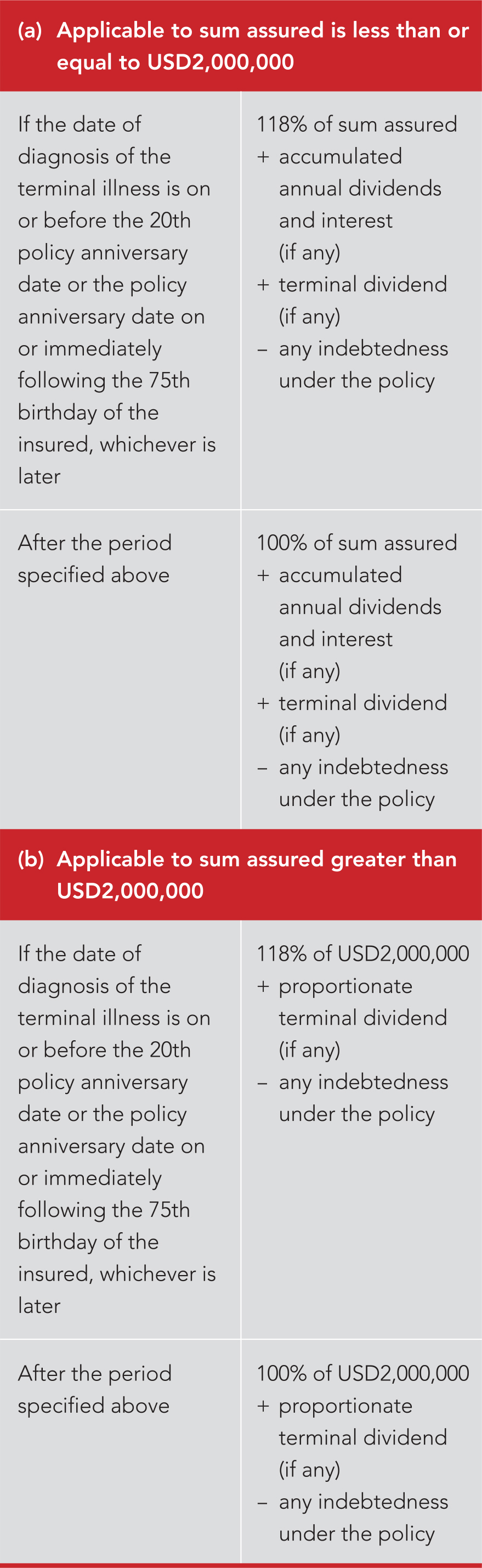

Terminal illness benefit2 to cope with anything unexpected

If the insured is unfortunately diagnosed with a terminal illness, the Plan will advance the death benefit as the terminal illness benefit, in order to provide additional cash to the insured for more appropriate arrangements.