Splendid Harvest Income Plan

Top 3 Advantages

Full Guarantee

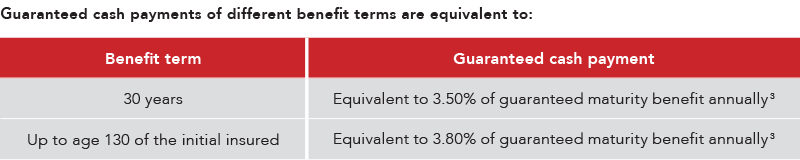

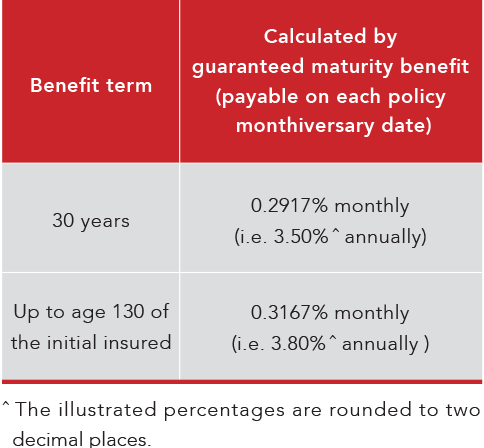

Providing guaranteed cash payments, guaranteed return and guaranteed capital preservation upon maturity

Monthly Income

Offering a monthly guaranteed cash payment to facilitate liquidity

Inheritance

Policy can be in force up to age 130 of the Initial Insured, featuring an easy way to pass on your wealth